Have a Dream Fixer-Upper, But Short on Cash? Don’t Worry.

If your dream home needs a little extra care which a regular mortgage cannot cover, don’t abandon your dreams instead opt for an FHA 203k mortgage. They are an excellent solution for aspirant homeowners with little down payment or a fair-to-average credit rating. Even if your potential home requires some renovation or repairs before you can move in, it doesn’t mean you need to let it go.

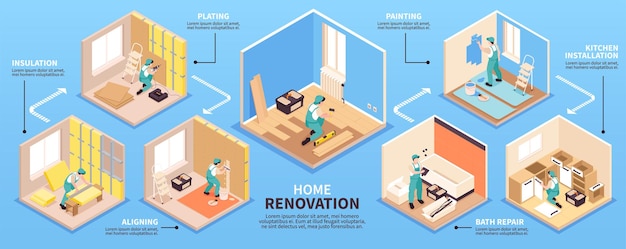

Luckily, 203k loans cover virtually any kind of repair or improvement – even the reconstruction of a leveled house, provided the original groundwork is intact. They cater to various improvements, from enhancing the home’s function to extensive landscape work and site improvements. So, if you desire to refurbish a fixer-upper but lack the necessary upfront finance, keep reading for more insights into the realty market and home refurbishing loans.

The Evolution of the Real Estate Market

The real estate market, despite drastic fluctuations over the past decade, has been gradually recovering. As the market rebounds in several regions, many houses wait to be repaired, remodeled, or renovated. Numerous foreclosure homes await to be transformed from fixer-uppers into dream houses. Simultaneously, as the market uplifts, funding home renovations is more accessible. The appropriate renovation loan could assist you in harnessing these market dynamics.

What is a Renovation Loan?

A renovation loan, or home renovation mortgage, relies on the property’s current value and the projected value after renovations. For instance, if a property is presently valued at $200,000 but is expected to be worth $250,000 after renovations, the higher value is calculated for the loan. This is beneficial if you can personally contribute labor – or “sweat equity” – to the renovation, reducing costs.

Government-backed financing is also available via an FHA 203K renovation loan, which supports buyers in acquiring properties needing cosmetic or even structural repair. This program permits a single mortgage to cover both the home purchase and revamping costs. The 203K loan necessitates the renovated property to be the borrower’s primary residence, making it unfit for house flipping. The streamlined variant of the program, the FHA 203K streamline loan, simplifies the process by capping renovation at $35,000 and stipulating the work to be cosmetic rather than structural.

Other financial aid programs are available for those keen on purchasing fixer-uppers but lack ready cash. Accessing the right financial support is crucial.

How to Access the Help You Need

While some may be daunted by high demands and credit scores needed for regular mortgages, remember the saying, “Necessity is the mother of invention.” With groundbreaking finance products, those previously ineligible are now potential homeowners. Renovations loans are enabling many people to own their first home, and even get back into one. Financial institutions like MyProspectMortgage.com possess the expertise and resources to help people secure the renovation loan most suited to their circumstances.