The United States is grappling with a debt crisis, with the national debt exceeding $30 trillion. This isn’t shocking considering that most American adults carry some form of debt, be it from student loans, mortgages, credit card debt, or other credit sources. However, this doesn’t deem credit as negative. It’s an integral part of our economic system.

Being confronted with the debt crisis and the potential to get trapped in a spiral of debts shouldn’t deter you from obtaining a loan when necessary. Still, it should act as a caution to be mindful of how you manage your borrowings. Unquestionably, some of the most accessible lending channels are simultaneously risky, with unscrupulous lenders offering products like payday loans accompanied by exorbitantly high-interest rates.

Thankfully, safer alternatives are available. Low-risk borrowing options can include your bank or credit union. Let’s examine some of the most reliable low-risk lending options.

BANK LOANS

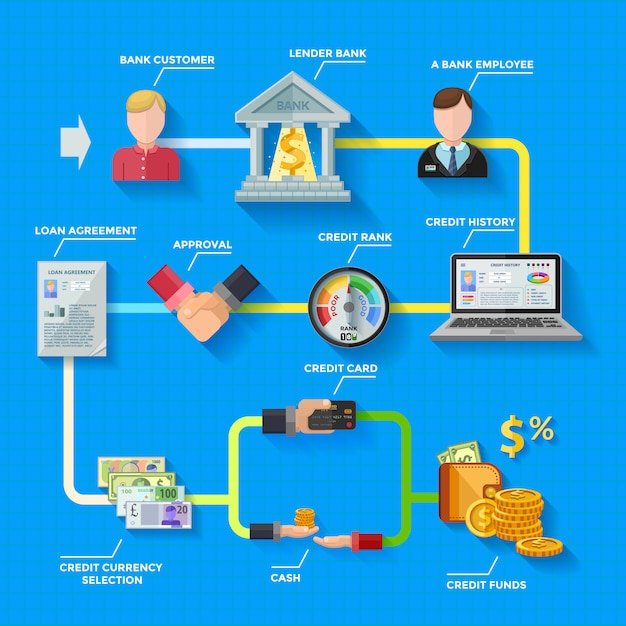

Many people’s initial options when contemplating a loan are banks, which is logical since banks already handle their financial services. Nowadays, banks provide a seamless online application process for their customers, leveraging the customer’s pre-existing data.

Bank loans are subject to stricter regulations than many other private lenders, preventing them from imposing unjustifiably high-interest rates. Consequently, banks are more likely to decline your loan application if you possess a poor credit history or show signs of possible repayment difficulties.

One downside to bank loans is the limited options for those under financial strain. Additionally, since banks are usually private or shareholder-owned, their obligations to others may supersede their commitment to clients. You may also be required to pay considerable application and administration fees.

CREDIT UNIONS

Credit unions are typically non-profit establishments owned by their members. As such, they often furnish the most favorable loan terms and lowest interest rates. Nevertheless, to borrow from them, you must be a member, accomplished by merely joining and starting an account with a nominal deposit.

Credit union loans are designed to be low-risk options, restricting the available loan types. Moreover, securing a loan could be challenging if deemed a high-risk borrower.

401(K) LOANS

Borrowing from your 401(k) may seem paradoxical to being low risk. Draining your retirement fund indeed poses a future risk. However, upon reviewing the advantages and restrictions, a 401(k) loan may appear quite feasible.

Securing a 401(k) loan is a simple task, requiring only a discussion with your company’s human resources department. Generally, the loan cap is at $50,000 or 50% of your existing savings – whichever is lower. While the loan is active, only the balance in your retirement plan will generate dividends.

A positive aspect of a 401(k) loan is, regardless of your credit status, the loan is accessible. Indeed, it’s a favored option for those with severely low credit scores. It’s important to note that a 401(k) loan neither harms nor improves your credit history.

The interest rates on 401(k) loans are typically 1% or 2% above prime, significantly lower than other personal loans, more so if your credit status is adverse. Notably, you essentially pay yourself interest since it’s funneled back into your retirement fund.

401(k) loans can be extended up to 5 years, providing sufficient time for you to settle some costly debts per month. By the time you need to repay your 401(k), you might be eligible for another low-risk loan.

In 2022, there are numerous other borrowing options, including peer-to-peer (P2P) lending, private lending companies, among others. However, the options mentioned above remain the safest channels to secure loans with low interest rates in your best interest. High-interest loans due to poor credit can push you further into debt, but in desperate times, you might not have another choice.

Always consider the above options before resorting to high-interest loans.